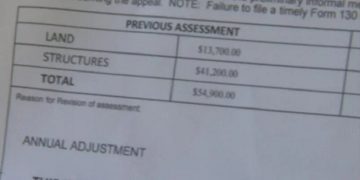

Indianapolis, Indiana – It’s approaching tax season, which is a time of year. According to experts, there are a few changes this year that may affect how you file.

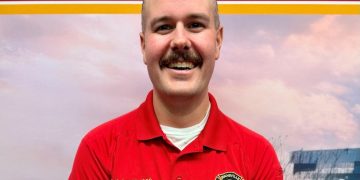

“The most important thing is you need to get started,” said Andy Mattingly, Chief Operating Officer at Forum Credit Union.

The end of January 2023 marks the beginning of tax season.

“A lot of people like to put it off but it’s really important to get started early for several reasons,” Mattingly said.

He advises that you begin planning your filing right away. You’ll have more time and better access to tax professionals if you file early and have a complicated return.

“The other thing is the longer you have to get certain documents because things get lost in the mail,” Mattingly said.

Avoiding tax fraud is among the most crucial justifications for early filing.

“One of the rising things we see is people will file a tax return in your name because your social security number got out in a breach,” Mattingly said. “They’ll file a tax return and get a refund, then you’ll go to file and won’t be able to. It’s a real mess.”

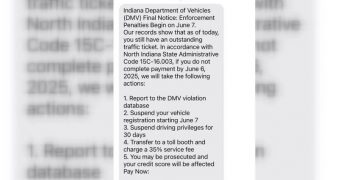

But you should be aware of other scams as well.

“I would be careful using a service you’ve never heard of that’s offering stuff for free because you do want to be careful of people just trying to get your information to get your identity,” Mattingly said.

Mattingly advises looking for a list of locations to file your return on the IRS website. Additionally, bear in mind some of the adjustments for the 2023 tax year.

“The income tax brackets are changing a little bit,” Mattingly said. “The rates aren’t changing, but they’re going up, so you might not be in the same bracket you were before so that’s a positive.”

There are additional changes to the child tax credit. If you’re unsure of how these changes may effect your return, Mattingly advises seeing a tax professional.

“One thing people get concerned with is ‘Oh, I’m going to owe taxes,’” Mattingly said. “That’s fine. You can file your taxes but don’t have to make the payment until the due date.”

All federal tax returns and payments must be submitted by April 18th. Your W-2 must be issued by your employer by January 31. You may get it sooner to start working on your submission if you’re willing to accept it electronically.