Indianapolis, Indiana – According to recent research, the cost of buying a home is rising, but Indianapolis is still among the most affordable big cities.

Financial firm Smart Asset claims Indianapolis was the most cost-effective place to buy property both this year and the year before. First-year costs, according to Smart Asset, have risen by more than 26% and are not expected to decline in 2023.

According to Bankrate.com, Indianapolis’s current 30-year fixed mortgage rates are close to 7%. That is in line with the national average, which according to Bankrate on Monday morning was 7.04%.

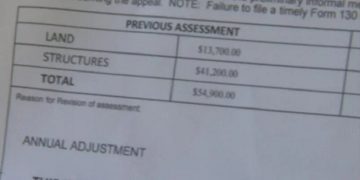

Additionally, according to data from Smart Asset, Indiana’s average home price is approximately $230,000, which is lower than the national median, and closing costs are typically just over $3,000 there.

Residential real estate agent Tiff Atkinson in central Indiana claims that her clients’ worries extend beyond making their mortgage payments.

According to Atkinson, additional charges including closing costs, house inspections, property taxes, and insurance can significantly reduce a buyer’s budget. She also asserts that buyers need cash upfront to pay for costs and suggests they engage with a certified lender to put together a financial overview.

“They are going to look at the fee associated with buying a home. But, unfortunately, a lot of those fees buyers don’t understand. They don’t consider taxes, private mortgage insurance, or fees. They don’t know what it takes to purchase a home,” Atkinson said.

Philadelphia, Houston, Columbus, Ohio, and Jacksonville, Florida were also recognized by Smart Asset as having more inexpensive housing costs for first-time homebuyers.

When it comes to the cities with the most expensive first-year costs of home ownership, California ruled. The top four cities on Smart Asset’s list were San Francisco, San Jose, Los Angeles, and San Diego, with San Francisco at No. 1 requiring an average down payment of about $317,000 and an average closing cost of $7,938.