Indianapolis, Indiana – Drivers in Indiana will have some respite at the pump after experiencing the highest fuel use tax in December in history.

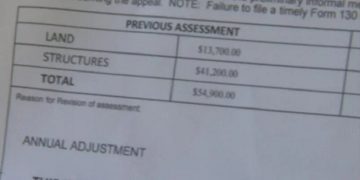

The January gasoline use tax computation was just released by the Indiana Department of Revenue. According to the calculations, the rate will drop from 23.3 cents in December to 19.9 cents on January 1.

The average retail price per gallon of gasoline during the previous month is multiplied by the state retail tax of.07 cents by the department to determine the gasoline usage tax. The average retail price, according to the state, was $2.8424.

The gasoline use tax for January 2018 is the highest on record. Since June 2020, when it was at its lowest point ever recorded, the tax has slowly climbed. Before 2022, the use tax on gasoline was never higher.

People who purchase fuel also pay additional state and federal taxes on top of the gasoline tax. As of July, consumers pay a federal tax of around 18 cents per gallon in addition to a petrol excise tax of 33 cents per gallon, which funds infrastructure initiatives.

One of the highest petrol excise taxes in the nation is in Indiana. Data gathered by IGEN shows that just 13 states have a higher gas excise tax than Indiana. The petrol excise taxes in Ohio and Illinois, two nearby states, are higher.

In January, individuals would pay about $3.55 at the pump if the average retail price of gasoline stays at $2.8424. According to AAA, the average price of gas in Indiana as of December 20 is approximately $3.019.

“The cost of oil, gasoline’s main ingredient, has been hovering in the low-to-mid $70s per barrel, and that’s $50 less than the peak last Spring,” said Andrew Gross, AAA spokesperson. “Combined with low seasonal demand, gas prices could slide a bit more before leveling off.”

GasBuddy predicts that national gas prices will drop to under $3 per gallon on or before Christmas.