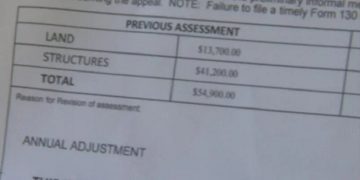

Evansville, IN — The Indiana Senate Committee passed Senate Bill 1 on Tuesday, a key piece of legislation designed to reduce property taxes across the state. However, the committee made several changes to the original proposal, sparking concern among local leaders and agencies.

The primary goal of the bill, championed by Governor Mike Braun, is to curb the rising burden of property taxes on Indiana residents. One of the central provisions in the original proposal was a 3% annual cap on the growth of property tax bills. However, this element was removed during the committee’s review, prompting a mixed reaction from various stakeholders.

City leaders in Evansville expressed concerns over the potential financial impact of the changes. They worry that the reduction in property tax revenues could lead to cuts in essential local services, as many municipalities rely on these funds to support education, public safety, and infrastructure projects.

Local government representatives and other public agencies have echoed similar concerns, emphasizing the importance of stable funding to maintain services that citizens depend on. The proposed reductions in property tax revenue, without adequate compensatory funding, could put pressure on local budgets, they argue.

Despite the amendments, Governor Braun remains optimistic. In a statement following the committee’s vote, he described the action as “a step in the right direction” and emphasized his commitment to working closely with legislators to refine the bill. The governor’s office is reportedly exploring additional ways to address concerns raised by local officials and ensure that the tax relief does not come at the expense of vital public services.

As Senate Bill 1 moves forward, it is expected that further discussions and adjustments will take place before it reaches the full Senate for a vote. The ongoing debate over property tax relief highlights the delicate balance between providing financial relief to homeowners and ensuring that local governments have the resources necessary to serve their communities.

With continued scrutiny from local governments and advocacy groups, the final version of Senate Bill 1 remains uncertain, and the implications for property tax reform in Indiana will likely continue to evolve in the coming weeks.