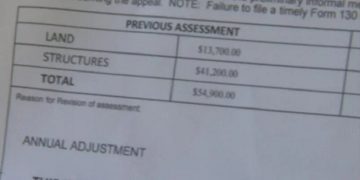

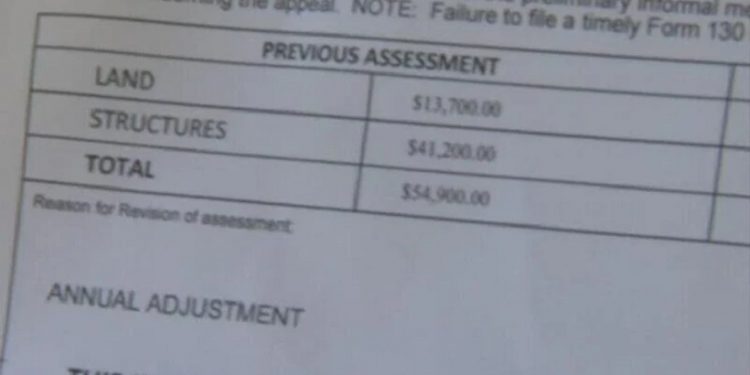

Evansville, IN — The Indiana House of Representatives has passed a new property tax relief bill aimed at easing the financial burden on homeowners across the state. The legislation, which was approved with significant support, proposes a property tax credit for homeowners, offering a 10% reduction on their property tax bills for their primary residences, capped at $300.

This move is part of a broader effort to provide relief to Hoosiers facing rising property taxes. Homeowners in Indiana have long expressed concerns over the growing cost of property taxes, and this bill seeks to address those concerns by offering a more immediate form of financial assistance.

To compensate for the revenue lost through the tax credits, the bill also includes provisions that would allow cities and towns with populations exceeding 3,500 to implement a local income tax rate of up to 1.2%. This measure aims to balance the budgetary impact of the property tax reductions, ensuring that local governments can maintain necessary services and infrastructure funding.

Governor Mike Braun has already expressed his support for the bill, signaling that it will likely be signed into law in the coming days. The Governor’s backing suggests a smooth path to final approval, which is expected to come as early as next week.

The new law represents a compromise between providing immediate relief to homeowners and securing the financial stability of local governments. However, some experts have raised concerns about the potential burden on residents in larger municipalities, where the new local income tax could offset some of the savings from the property tax credit.

As the bill progresses toward becoming law, it remains to be seen how the measure will impact both homeowners and local economies across the state. For now, many are hopeful that the legislation will bring much-needed financial relief to Indiana’s residents while maintaining essential local services.