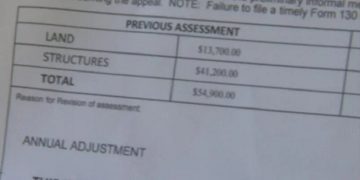

Indianapolis, Indiana – In this session, Indiana lawmakers may approve property tax relief due to the increase in assessed home values.

Republican state legislators have stated that this topic is one of their top priorities for the coming year.

“We know that homeowner tax bills have gone up quite a bit, and we believe they’ll go up again next year,” said State Rep. Jeff Thompson (R-Lizton), who chairs the House Ways and Means committee.

Thompson introduced House Bill 1499, which would temporarily lower Indiana’s 1% cap on residential property taxes among other forms of property tax relief.

For taxes that are first due and payable in 2024 and 2025, respectively, the maximum would be reduced to 0.95% and 0.975%, respectively.

“It will help those homeowners and not have such a large increase,” Thompson said.

The House passed the bill with nearly unanimous support, and the Senate is now debating it.

Ed DeLaney (D-Indianapolis), a state representative, says Indiana’s property tax structure requires long-term adjustment but still supports the proposal.

“Put simply, our 1% property tax cap, our system is showing its age,” he said at a news conference Monday.

He suggests, among other things, increasing state support for education.

Indiana’s local governments and schools receive money through property taxes.

“The taxes could be used if we relieve the pressure on the schools by giving them more taxes from the state, more revenue from the state, that would create funds to fix things like roads and hire police,” DeLaney said.

Thompson stated that he and House Republicans would research potential future long-term changes.

Local government officials express fear that if lawmakers cut the property tax ceiling, their main source of income will be negatively impacted during the following two years.

“We might be open fewer hours,” said Republican Mayor Dan Ridenour of Muncie. “We might not have as many streets paved.”

According to Ridenour, property taxes account for 65% of the money his city receives.

“This was being thrown on us without any advance warning and therefore we may have negotiated contracts and/or salary increases that will now be very difficult to pay,” he said.

“It’s going to be a decrease in the increase,” Thompson said in response to those concerns. “We’ve had a huge increase, and so we’re going to decrease part of that increase.”

Senate Bill 3, which would establish a panel to review all of Indiana’s tax laws and consider revisions, is also being advanced by legislators in Indiana.