Indianapolis, Indiana – Some Hoosiers may have already received the dreaded call pleading with them to settle their medical bill. But what if the person on the other end of the line isn’t who they claim to be? Consumers are being cautioned by the Central Indiana Better Business Bureau (BBB) about the risks posed by the rise in medical bill scams.

Recent reports involving fake medical bills and collections departments have been sent to BBB Scam Tracker.

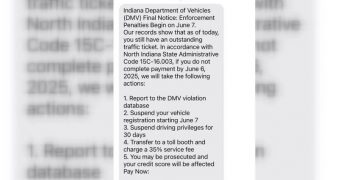

According to BBB representatives, the scam starts when you get a letter or call saying you owe money on a medical bill. If you pursue the matter, the “billing department” will insist that you pay right away. According to reports, there will be repercussions for noncompliance, including fines, harm to your credit, or even jail time.

After the “false warning,” many consumers will be eager to pay off debts and will provide their credit or debit card information. However, the con artist will need confirmation of your identity, address, and other private information prior to accepting payment. Your social security number or bank account number are frequently included.

The con comes in a variety of forms. In certain cases, the medical bills and services are wholly fake. One person told BBB Scam Tracker that they, “received a medical bill for $500 for Covid testing that supposedly occurred in VA in January. I did a quick look into the business website and the site wasn’t even registered/live until May. I was also out of state (in CA) when it claims I got tested.”

Sometimes a doctor’s visit was genuine, but the business that is claiming you owe money is a fraud. One BBB Scam Tracker report states, “I received a medical bill on 01/18/2023. I called the billing department number on the statement. However, I miss-dialed[sic] the number… and I was re-directed to a possible scam agency.” The “billing department” in this instance demanded the caller’s email, credit card information, birthday, and other private details.

The caller was informed that the bill had been paid and that an email confirmation will be sent. But that wasn’t the case. Giving away your personal information puts you at risk for identity theft regardless of the scam type used. Also, depending on the supporting documentation and bank you pick, any money paid could be permanently lost.

How to prevent medical billing fraud

1. Verify the claims

o If someone claims you owe money always ask for details. Any legitimate collections company should be able to tell you to whom you owe money and when you received services. Consider it a red flag if they aren’t forthcoming with this information. In any case its always a good idea to hang up and contact your doctor’s office directly, hospital billing department or even insurance company to find out what money is owed.

2. Look up the customer service number

o Do an internet search on the phone number that contacted you or the customer service number on the letter received. The number should be registered to an official business associated with your doctor or hospital. If not then consider it a red flag. Also keep out an eye for reports of the number being identified as a scam.

3. Don’t give in to scare tactics

o Scammers often try to make you feel like there will be extreme consequences if you don’t pay up immediately. Don’t be intimidated by a stranger who contacted you out of the blue. legitimate businesses won’t threaten if you ask questions or want to verify information before making a payment.

4. Guard your personal info carefully

o If you are called unexpectedly and asked to “verify” your personal information always think twice. Be sure you’re talking to someone you know and trust before divulging information that could be used to commit identity theft. Even if the caller on the other end sounds professional.

You may read about a similar fraud on BBB for more details. Advice: Healthcare scammers want your personal data.

Visit “10 Steps to Avoid Scams” for additional information on how to protect yourself.