A change to the city of Bloomington’s tax abatement policy, approved by the city council on Wednesday last week, will make it easier for affordable housing projects to satisfy abatement criteria

The change replaces the basic criterion for tax abatement. In the previous policy, the basic requirement was that the project create full-time, permanent living-wage jobs.

In the revised policy, which won unanimous approval on Wednesday night, the basic requirement is creation of capital investment as an enhancement to the tax base.

Job creation is still a part of the mix for tax abatements. But it has the same status as two other criteria, listed under the basic requirement about creation of capital investment: significant increases to existing wages; and creation of affordable housing units.

During public commentary, the tax abatement policy change received support from Geoff McKim, who serves on the city’s five-member economic development commission (EDC), which reviews and recommends applications for tax abatements.

McKim said, “I strongly support these changes to your guidelines. It’s always been, honestly, a little cringeworthy to try to justify affordable housing projects—which nearly everyone was in support of—on the basis of creation of a halftime apartment maintenance position.”

McKim added, “Your tax abatement guidelines should support the policies that you want to achieve through abatements. And if affordable housing is one of those policy goals, this change helps support that policy.”

McKim also serves on the Monroe County council.

The push to change the policy can be traced back at least as far as the end of July 2020, when the city council did its annual review of tax abatements.

At the council’s July 29, 2020 meeting, councilmember Piedmont-Smith asked about the Urban Station project at 403 South Walnut St., which was approved for a tax abatement in 2016.

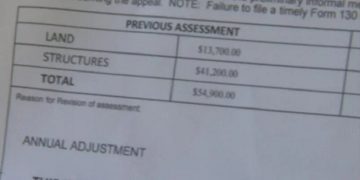

Urban Station was supposed to construct a four-story, mixed-use building with 7,000 sq ft of commercial space on the first floor, and one new four-story residential building. The residential building was planned to include affordable housing in the form of five 1-bedroom units and five 2-bedroom units, that would be offered for lease in the “workforce” affordable category for 99 years.

As part of the stated benefit, to justify the tax abatement, Urban Station was also supposed to retain 10 jobs and create 5 jobs. The slide presented to the council at the July 29, 2020 meeting showed the estimated 10 jobs that were supposed to be retained, but in the “actual” column, the slide indicated “NA” or not applicable. The slide also showed 4 actual jobs created instead of 5.

Piedmont-Smith asked the city’s economic and sustainable development director, Alex Crowley: “So did they retain 10 jobs or did they not?” Piedmont-Smith also asked about the estimated 5 jobs to be created, compared to the 4 actual jobs created.

At the time Crowley said, “You know, I think this is a good example of where the guidelines are perhaps not set up correctly.” He continued: “This is primarily an affordable housing tax abatement. And what we’ve tried to do is kind of force-fit requirements having to do with employment into structures that really are about a different priority.”

Crowley said that the finding of substantial compliance with Union Station’s statement of benefit was: “We’re really evaluating this on the basis of what was intended to do, which was to make an actual investment.”

The revised policy, approved by the city council on Wednesday, now explicitly states that creating a capital investment is the main point of Bloomington’s tax abatement policy.