Indianapolis, Indiana – You are not alone if the rising cost of everything and inflation have you using credit cards more frequently these days.

The Federal Reserve Bank said that in the first quarter of 2023, total household debt in the United States increased by $148 billion, reaching over $17 trillion.

Within that sum, credit card balances have reached $986 billion, which is above average and around the same as where they will be at the end of 2022. The first quarter of the year typically sees a decline in credit card balances.

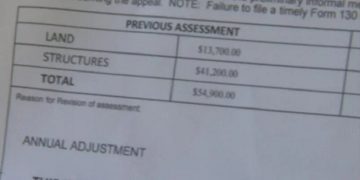

At the end of March, mortgage balances were $12 trillion, an increase of $121 billion. There are currently $1.56 trillion in student loans. The amount of auto loans is $1.6 trillion.

According to some analysts, many households’ credit card usage has reached an unsustainable level, and there are indications that more Americans are adapting their lifestyles to cope.

People are keeping their vehicles longer in order to take out fewer auto loans, claims S&P Global Mobility. According to the firm, the current record-breaking average age of automobiles on the road is 12-and-a-half years.

Due to the fact that homeowners with lower rates do not want to begin paying 6%, mortgage refinancing has also decreased.

A rise in debt being past due was also noted in the Federal Reserve Bank’s report.

If all of this sounds dismal, assistance is available.

The top debt counseling firms are listed on the Consumer Affairs website. Additionally, BankRate.com provides help and information on nonprofit debt reduction.

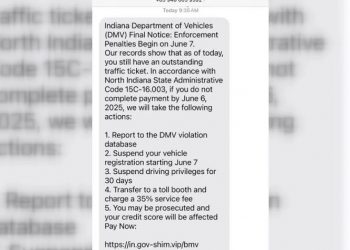

These may be worthwhile choices for someone trying to alter their financial direction. Just be wary of con artists who demand cash before offering to assist you with your debt problems.