California’s Democratic Senators have recently proposed a tax plan that aims to levy higher taxes on some of the largest corporations operating in the state while reducing taxes for small businesses. The proposed plan has generated strong opposition from businesses and Democratic Governor Gavin Newsom, leading to a rocky path in budget negotiations ahead for California.

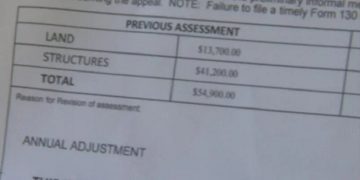

Currently, all businesses in California are subjected to a state tax rate of 8.84% on their income. However, the proposed plan would create two separate tax rates for businesses. Businesses earning less than $1.5 million would only pay a 6.63% tax rate, while the remaining of their earnings would be taxed at a higher rate of 10.99%, according to Dallas Press News.

The new tax rate would only apply to 2,500 corporations and is expected to increase the state’s annual revenue by $7.2 billion. The remaining small businesses would benefit by paying a lower tax rate, reducing state revenue by approximately $2.2 billion. The pending $5 billion would help low-income earners, fund tax credits, and enhance public programs in California such as public education, child care, and combatting homelessness.

While the plan has a long way to go before becoming law, as tax increases require two-thirds votes from both houses of the Legislature, Democrats who control the majority seats in both chambers are supporting the new proposal. The tax increase is being sold as a partial reversal of the federal tax cuts signed into law by former Republican President Donald Trump, which nearly every Democrat in California opposed, including Gov. Newsom.

Despite the Democrats’ support, Democratic Gov. Gavin Newsom is opposing the proposal, preferring not to raise taxes in the past, as he has been building his national profile in recent years in advance of a possible run for president beyond 2024. Newsom has previously campaigned against a ballot initiative that would have increased tax rates on the wealthy to fund environmental programs. During a press conference, Newsom’s spokesman Anthony York said that the governor could not support the proposal, stating, “It would be irresponsible to jeopardize the progress we’ve all made together over the last decade to protect the most vulnerable while putting our state on sound fiscal footing.”

The California Chamber of Commerce has also opposed the proposal, stating that a tax increase would “send the wrong signals to job creators and investors in the state’s economy,” while John Kabateck, California state director for the National Federation of Independent Business, believes that the proposal “looks appealing at first glance” but advises caution in endorsing it. The proposal will face much debate and opposition before becoming law, but it holds the potential to promote equitable tax reform in California.